|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Avoid Filing Bankruptcy: Essential Strategies to Protect Your Finances

Filing for bankruptcy can be a daunting decision with long-term consequences. Fortunately, there are several strategies you can employ to avoid this drastic measure. By understanding your financial situation and taking proactive steps, you can protect your credit score and secure your financial future.

Understanding the Implications of Bankruptcy

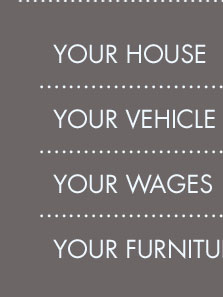

Before exploring alternatives, it's crucial to comprehend the implications of bankruptcy. It can severely impact your credit score and remain on your credit report for up to ten years. This can affect your ability to secure loans, find housing, and even gain employment.

Long-term Consequences

Bankruptcy can result in the loss of property and a tarnished credit history, making it difficult to recover financially.

Effective Strategies to Avoid Bankruptcy

Implementing the right strategies can help you manage your debts and avoid filing for bankruptcy.

1. Budgeting and Financial Planning

Create a budget: Track your income and expenses to identify areas where you can cut costs. Prioritize essential expenses and allocate funds toward debt repayment.

2. Debt Consolidation

Consider consolidating high-interest debts into a single, lower-interest loan. This can reduce your monthly payments and simplify your financial obligations.

3. Negotiating with Creditors

Reach out to your creditors to discuss potential repayment plans or settlement options. They may be willing to negotiate to avoid the cost and hassle of bankruptcy proceedings.

4. Seeking Professional Advice

Consulting a financial advisor or credit counselor can provide personalized guidance tailored to your financial situation. For expert advice in specific locations, you might consider reaching out to Toledo bankruptcy lawyers or a bankruptcy attorney Anaheim CA.

Exploring Additional Resources

- Government Programs: Investigate government assistance programs that can offer temporary financial relief.

- Community Resources: Local organizations may provide support through financial education workshops and counseling services.

Frequently Asked Questions

What are the alternatives to bankruptcy?

Alternatives include debt consolidation, negotiation with creditors, financial counseling, and budgeting. Each option can help manage debts more effectively.

How can a financial advisor help me avoid bankruptcy?

A financial advisor can assess your financial situation, provide budgeting advice, and suggest debt management strategies tailored to your needs.

Is debt consolidation a viable option for everyone?

While debt consolidation can be beneficial, it may not suit everyone. It is important to consider interest rates, fees, and eligibility requirements.

Debt consolidation, in which several high-interest debts are paid off with one lower-interest loan, is often mentioned as a tool to avoid bankruptcy. If you ...

This alternative to filing bankruptcy may not be the best one for most individuals. Debt settlement companies (which often market themselves as ...

I would recommend bankruptcy. Many people are afraid of bankruptcy, but with the significant number of people that file it every day, the stain ...

![]()